how much is inheritance tax in nc

Initiatives were floated to repeal Nebraskas inheritance tax and North Carolinas estate tax in 2012 but nothing happened on this front in Nebraska. For example lets say a family member passes away in an area with a 5 estate tax and a 10 inheritance.

What Is Inheritance Tax And Who Pays It Credit Karma Tax

Inheritance taxes are levied on heirs after they have received money from the deceased.

. No Inheritance Tax in NC. How much tax do I pay in NC on inheritance of 33000 thirty three thousand dollars. In 2021 federal estate tax generally applies to assets over 117 million.

His sister will pay a. As a descendent over the age of 21 John Does son will pay a 45 percent inheritance tax for a total of 1125. Iowa Extended family pays a 5 percent tax on the first 12500 of the inheritance and up to 10 percent of estates worth over 150000.

- Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website. However state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1206 million. The legal process of dealing with a decedents estate in North Carolina is known as probate.

North Carolinas estate tax was ultimately repealed in July 2013. There is no inheritance tax in North Carolina. If you live in a state that does have an estate tax you may be expected to pay the death tax on the money you inherit from a death in NC.

North Carolina does not collect an inheritance tax or an estate tax. However there are sometimes taxes for other reasons. North Carolina Inheritance Tax and Gift Tax There is no inheritance tax in North Carolina.

Even though North Carolina does not collect an inheritance tax however you could end up paying inheritance tax to another state. No Inheritance Tax in NC There is no inheritance tax in NC so if you give 18000 to your niece at your death you dont need to worry about your estate or her paying taxes on it. North Carolina does not collect an inheritance tax or an estate tax.

Charitable and nonprofit organizations dont pay a tax if the amount is less than 500 but 10 percent of anything over the amount. The legal process of dealing with a decedents estate in North Carolina is known as probate. The inheritance tax of another state may come into play for those living in North Carolina who inherit money.

If you inherit from somone who lived in one of the few states that has an inheritance tax--Iowa Kentucky Nebraska New Jersey Pennsylvannia and Maryland --you may get a tax bill from that state. How Much is Inheritance Tax. The inheritance tax of another state may come into play for those living in.

If you inherit property in Kentucky for example that states. There is no inheritance tax in NC. How Long Does It Take to Get an Inheritance.

Items included in the deceased persons taxable estate include real estate vehicles and the proceeds from life insurance policies explains Nolo. These are some of the taxes you may have to think about as an heir. However state residents should remember to take into account the federal estate tax if.

North Carolina Inheritance Tax and Gift Tax. On November 6 2012 Ballot Measure 84 which would have repealed Oregons estate tax by January 1 2016 was defeated by a. However there are sometimes taxes for other reasons.

1-800-959-1247 email protected 100 Fisher Ave. A surviving spouse is the only person exempt from paying this tax. Distant family and unrelated heirs pay between 10 and 15 percent of the value of the inheritance.

There is no federal inheritance tax but there is a federal estate tax. Inheritance taxes are paid by beneficiaries of an inheritance on the amount they receive. The inheritance tax rate in North Carolina is 16 percent at the most according to Nolo.

Bank accounts certificates of deposit and investment.

North Carolina Estate Tax Everything You Need To Know Smartasset

In Addition To The Federal Estate Tax Which Is Fourth Highest In The Oecd Many U S States Levy Their Own Estate Inheritance Tax Estate Tax Estate Planning

Death And Taxes Inheritance And Estate Tax In The Carolinas King Law

Online Tax Preparation Services Company Kohari Gonzalez Pllc Income Tax Return Tax Return Income Tax

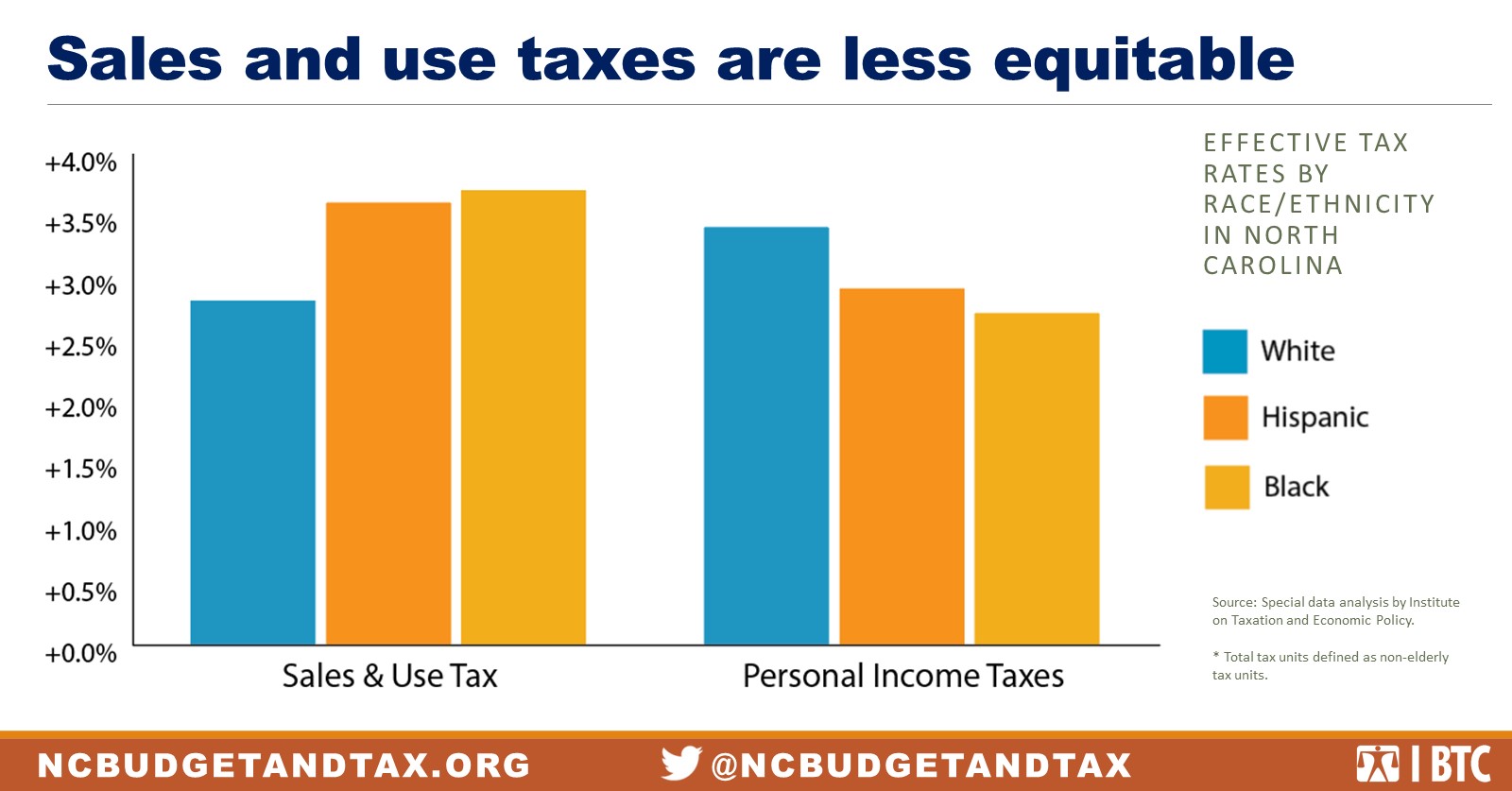

State Tax Policy Is Not Race Neutral North Carolina Justice Center

Is There A Federal Inheritance Tax Legalzoom Com

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Federal Gift Tax Vs California Inheritance Tax

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

Digital Product On Twitter Financial Aid For College Last Will And Testament Inheritance Tax

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

Map Of Earned Income Tax Credit Eitc Recipients By State Map Happy Facts Teaching Geography

States With No Estate Tax Or Inheritance Tax Plan Where You Die

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

North Carolina Estate Tax Everything You Need To Know Smartasset

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

North Carolina Estate Tax Everything You Need To Know Smartasset